3 Financial Statements and How They Work

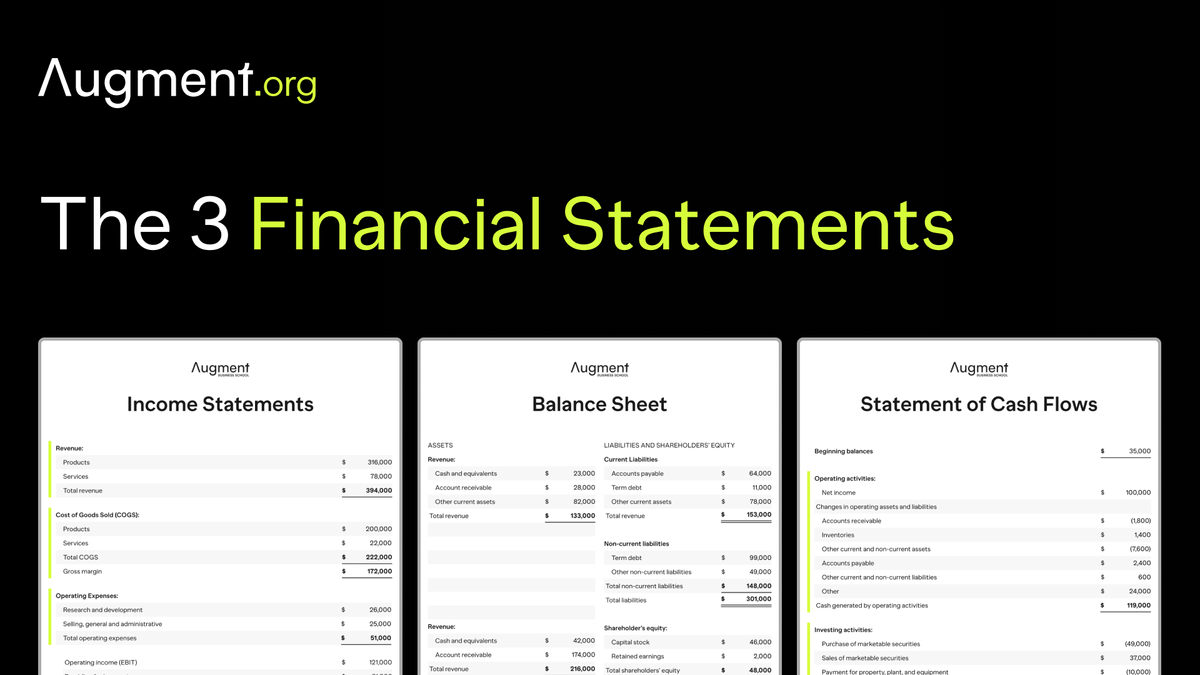

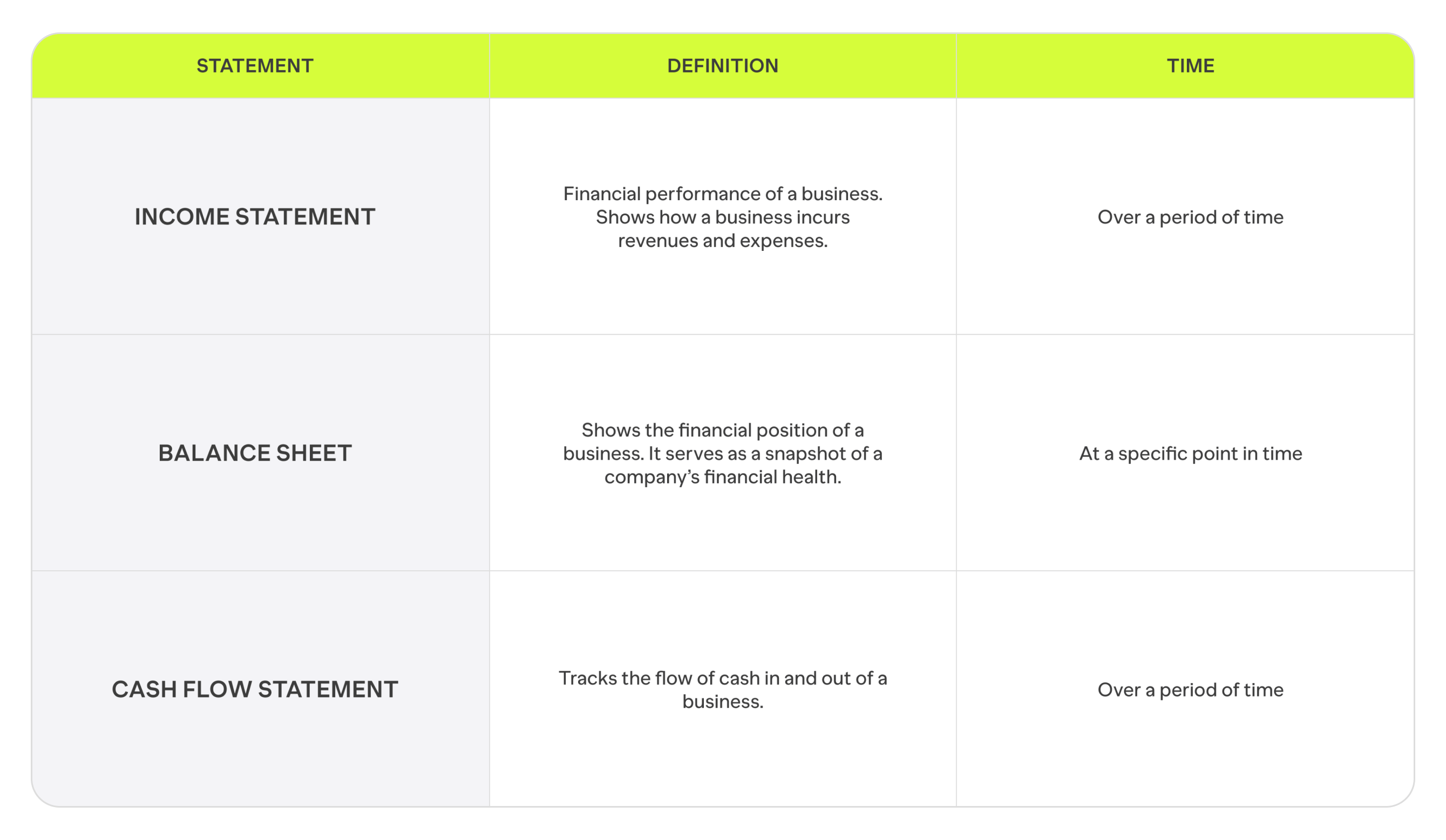

The three main financial statements are the income statement, balance sheet, and cash flow statement. The income statement shows earnings and expenses, the balance sheet lists assets and liabilities, and the cash flow statement tracks cash movement.

What are Financial Statements?

Financial statements are like the financial dashboard of a company. They consist of three key reports: the income statement, balance sheet, and cash flow statement. Together, these documents paint a complete picture of a company's financial health and its ability to create value.

The income statement details a company's earnings and expenses to highlight the net income. The balance sheet lists all the company's assets, liabilities, and shareholders' equity, offering a snapshot of the financial position at a specific point in time. Finally, the cash flow statement reconciles net income with actual cash entering and leaving the company, revealing the company's cash balance and its ability to maintain and grow its operations.

Each statement serves its purpose, working in tandem to provide a transparent view of a company’s financial performance over a certain period.

Below is a video extract from our Instructor of the Financial Accounting Class, Dr. Kelly Richmond Pope, the renowned forensic accounting expert and educator. In this course extract, she breaks down the three key financial statements in an easy-to-understand way.

Financial Statement #1: What is an Income Statement?

The income statement, also known as the profit and loss statement, is a financial statement that shows a company's revenues and expenses during a particular period. It begins by listing how much revenue the company earned, then deducts the cost of goods sold and operating expenses to calculate the gross profit. From there, any additional expenses, like interest expense and income tax, are subtracted to reveal the net income, which is the company's net profit or loss for the period.

This statement is crucial for understanding how much money a company makes from its operations and how much it spends to generate that income. It’s a go-to document for assessing a company's financial performance and its ability to generate profit over time.

Income Statement Example

Imagine a lemonade stand as a simple example of an income statement. Let's say the stand earned $100 from selling lemonade over the weekend. This amount is the revenue. To make the lemonade, lemons, sugar, and cups were purchased, costing $30—this is known as the cost of goods sold. Subtracting this from the revenue, the gross profit is $70.

Next, the stand had other expenses; $10 for a permit and $20 for a table rental, totaling $30 in operating expenses. After deducting these, the operating income is $40. No interest expense or income tax for this small business, so that $40 is also the net income. This net income shows the actual profit after all expenses are paid.

This simple breakdown reflects the core of an income statement, which for larger companies includes more detailed items like interest income, non-cash expenses, and income tax, all leading to the company's net income for the accounting period.

Financial Statement #2: What is a Balance Sheet?

A balance sheet is a financial statement that shows what a company owns and owes; it's like a financial snapshot at a specific point in time. This statement is divided into two main sections: assets on one side, and liabilities plus shareholders' equity on the other.

Assets, like cash assets, accounts receivable, and long-term assets, represent what the company owns or is owed. Liabilities include what the company owes to others, like loans or accounts payable. Shareholders' equity is the portion of the balance sheet that represents the capital received from investors plus the retained earnings from the company's operations.

The key to the balance sheet is understanding that it's balanced — the total assets must equal the sum of liabilities and shareholders' equity. This balance reflects a company's financial position and helps in determining the company's financial condition and the business's financial health. It provides a basis for computing rates of return and evaluating the capital structure of the business.

Balance Sheet Example

Let’s take a closer look at a balance sheet example. Imagine a bookstore with the following financials at the end of December:

Assets:

- Cash and cash equivalents: $5,000

- Accounts receivable: $2,000

- Inventory: $8,000

- Fixed assets like furniture and shelves: $5,000 Total Assets: $20,000

Liabilities:

- Accounts payable (money owed to suppliers): $4,000

- Long-term debt (like a small business loan): $6,000 Total Liabilities: $10,000

Shareholders’ Equity:

- Initial investment by the owner: $6,000

- Retained earnings (profits reinvested in the bookstore): $4,000 Total Shareholders’ Equity: $10,000

Adding the total liabilities and shareholders’ equity, we get $20,000, which equals the total assets, thus balancing the sheet. This example demonstrates how the balance sheet shows a company’s financial position, with the assets it controls and the obligations it has on a given date.

The balance sheet is critical for determining financial health, as it highlights what the company can use to grow and what it owes to creditors and investors.

Financial Statement #3: What is a Statement of Cash Flows?

The statement of cash flows, another cornerstone among the three financial statements, tracks the cash that enters and leaves a company over a period of time. Unlike the income statement, it doesn’t include non-cash items, focusing solely on actual cash transactions. This statement is divided into three main sections:

- Operating activities: This section shows the cash generated or used by a company’s everyday business operations. It starts with the net income and then adjusts for non-cash expenses and changes in working capital, like accounts receivable and payable.

- Investing activities: Here, a company reports cash spent on long-term assets that will help the business grow, like purchasing equipment, or cash received from selling such assets.

- Financing activities: This part details cash a company raises by selling shares or taking on loans, minus any repayments of debt or dividends paid to shareholders.

The net change in cash shown at the bottom of this statement adds to or subtracts from the cash balance reported on the balance sheet. By examining the cash flow statement, stakeholders can understand how a company’s operations, investments, and financing activities affect its cash position, which is a vital indicator of financial health.

Statement of Cash Flows Example

For an example of a statement of cash flows, let's look at a local bakery's cash activities for the year:

Operating Activities:

- Net income: $15,000 (money earned after all expenses)

- Depreciation expense: $1,000 (non-cash expense for equipment wear and tear)

- Increase in accounts receivable: -$500 (money not yet received for sales)

- Increase in accounts payable: $300 (expenses incurred but not yet paid) Net cash provided by operating activities: $15,800

Investing Activities:

- Purchase of new oven: -$5,000 (cash outflow for long-term investment) Net cash used in investing activities: -$5,000

Financing Activities:

- Loan received: $10,000 (cash inflow from new loan)

- Repayment of old loan: -$4,000 (cash outflow for repaying part of a loan)

- Dividends paid: -$1,000 (cash outflow to shareholders) Net cash provided by (used in) financing activities: $5,000

Net increase in cash: $15,800 (from operating) - $5,000 (from investing) + $5,000 (from financing) = $15,800 Cash at beginning of year: $2,000 Cash at end of year: $17,800 (this will be the new cash balance on the balance sheet)

This bakery's statement of cash flows shows not just its net income but also how cash has been received and spent, giving a clear view of its actual cash position.

Book a call with our Program Director

Book a 15-minute call with our Program Director to discuss your goals and what the Augment MBA has to offer.

Book a callHow Do the 3 Financial Statements Work Together?

The three financial statements – the income statement, balance sheet, and cash flow statement – are used together to provide a comprehensive overview of a company's financial performance and position.

- Income Statement Connection: The income statement shows a company’s profitability, including revenue, operating expenses, and net income over a specific period. The bottom line of the income statement, the net income, is the link to the other two statements. This figure is used as the starting point on the cash flow statement and is also added to retained earnings on the balance sheet.

- Balance Sheet Tie-In: The balance sheet provides a snapshot of a company's financial position at a specific point in time, detailing its assets, liabilities, and shareholders' equity. The net income from the income statement contributes to the shareholders' equity on the balance sheet through retained earnings, showcasing how the profits are either reinvested in the company or distributed to shareholders.

- Cash Flow Statement Integration: The cash flow statement reveals how changes in the balance sheet and income statement affect cash and cash equivalents. It adjusts net income from the income statement for non-cash transactions and changes in balance sheet items to show actual cash flow. This statement is crucial for understanding a company's liquidity and how it funds its operations and growth.

Together, these three financial statements provide a full picture of the company’s financial health. They show not just how much money a company made (income statement) or has at a moment in time (balance sheet), but also where it came from and where it went (cash flow statement). When examined side by side, these statements offer deep insights into a company's operations, enabling stakeholders to make informed decisions about investing in, managing, or extending credit to the company.