Financial and Managerial Accounting Explained

Financial and managerial accounting form the backbone of business decision-making, blending detailed reports and financial data to guide strategic direction.

What is Financial Accounting?

Financial accounting is the cornerstone of business transparency, providing a clear picture of a company's financial health. This discipline involves preparing financial statements and communicating financial information to external stakeholders like investors and financial institutions. Financial accountants adhere to established accounting standards, including the Generally Accepted Accounting Principles (GAAP) in the U.S., ensuring accuracy and comparability in financial reporting.

This process is vital for evaluating a company's performance over a specific period. Through financial accounting, businesses create detailed reports, such as income statements and cash flow statements, which offer insights into their operational effectiveness and financial stability. These reports are essential tools for external users, guiding investment decisions and providing a factual basis for valuation financial accounting.

Financial accounting plays a crucial role in maintaining the legal status and financial transparency of businesses, serving as a key component in the larger sphere of financial and managerial accounting.

What is Managerial Accounting?

Managerial accounting, often referred to as management accounting, is a dynamic field focused on providing internal management with the financial data and operational reporting they need to make informed business decisions. Unlike financial accounting, which concentrates on external reporting, managerial accounting directs its attention towards internal analysis, budgeting, and strategic planning.

At the heart of managerial accounting are detailed managerial reports that help in examining financial information from a managerial perspective. These reports include various financial and quantitative analyses, offering insights into cost accounting, performance metrics, and operational efficiencies. Managerial accountants play a critical role in this process, analyzing complex accounting processes and translating financial data into actionable information.

This discipline is crucial for internal stakeholders, like senior employees and department heads, in crafting strategies and steering the company towards its financial goals. Managerial accounting focuses on the future, using historical data to forecast trends and guide resource allocation, directly impacting the company's financial health and long-term success.

How are Financial and Managerial Accounting Similar?

While financial and managerial accounting serve different purposes, they share several key similarities:

- Common Foundation in Financial Data: Both financial and managerial accounting are grounded in the use of financial data and the creation of financial statements.

- Accuracy and Detail Oriented: Accuracy is crucial in both fields, with financial accountants and managerial accountants focusing on detailed and precise reporting.

- Adherence to Accounting Standards: Both areas comply with established accounting standards, ensuring consistency and reliability across financial and managerial reports.

- Role in Business Decisions: Whether it's for external stakeholders in financial accounting or internal strategy in managerial accounting, both contribute significantly to informed business decisions.

- Use of Contemporary Accounting Research: Ongoing accounting research influences both fields, keeping them up-to-date with evolving business practices and regulations.

- Professional Expertise: Both financial accountants and managerial accountants require a deep understanding of financial principles and quantitative analysis for effective decision-making.

How Are Financial and Managerial Accounting Different?

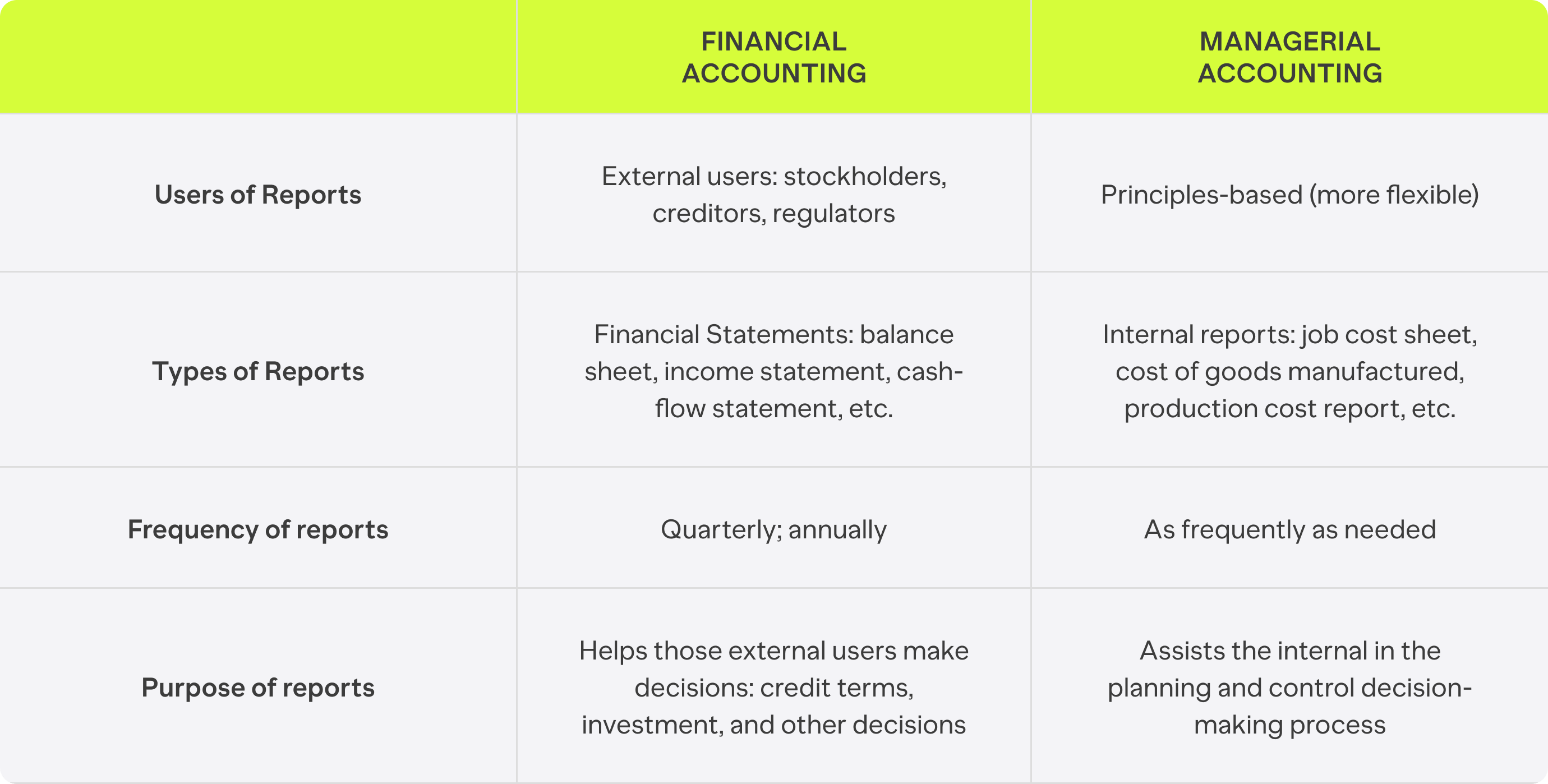

Financial and managerial accounting, while overlapping in some aspects, have distinct differences:

- Audience Focus: Financial accounting is geared towards external stakeholders, like investors and regulators. Managerial accounting, on the other hand, is focused on internal stakeholders, such as company managers and employees.

- Reporting Standards: Financial accounting follows strict standards set by bodies like the Financial Accounting Standards Board, ensuring uniformity in financial statements for external review. Managerial accounting is more flexible, tailored to meet the specific needs of a business's internal management.

- Nature of Reports: Financial accounting reports are formal and standardized, often including balance sheets and income statements. Managerial accounting reports are more varied and can include budgeting forecasts, cost analyses, and other operational reports.

- Time Orientation: Financial accounting typically looks at past performance, presenting a historical view of financial health. Managerial accounting is forward-looking, focusing on current and future financial planning and strategy.

- Scope and Detail: Managerial accounting delves deeper into specific segments of a business, providing detailed insights for internal decision-making. Financial accounting offers a broader overview of a company’s financial status as a whole.

- Regulatory Requirements: Financial accounting is heavily regulated and must adhere to specific legal and ethical standards. Managerial accounting, while guided by best practices, is not bound by these same regulatory constraints.

These differences highlight how financial and managerial accounting serve unique but complementary roles in a business's financial ecosystem.

Is One More Difficult Than the Other?

Comparing the difficulty of financial and managerial accounting is not straightforward, as it often depends on individual preferences and strengths. Here are some considerations:

- Nature of the Work: Financial accounting often involves following strict guidelines and producing standardized financial statements. This can be challenging for those who prefer more creative, less structured tasks. On the other hand, managerial accounting, with its focus on internal reports and forward-looking data, might be more challenging for those who prefer clear, set rules.

- Learning Curve: For students and professionals, the learning curve in each can vary. Some find the regulatory and compliance aspects of financial accounting complex, while others may find the strategic and analytical aspects of managerial accounting more challenging.

- Professional Certification: Becoming a certified public accountant (CPA) or a certified management accountant (CMA) requires mastering the respective fields. Each certification has its own set of challenges and focuses, reflecting the intricacies of each accounting discipline.

- Adaptability: Managerial accounting often requires adaptability and quick thinking due to its dynamic nature and the need for tailored solutions. In contrast, financial accounting demands meticulousness and a strong grasp of established accounting standards and principles.

- Contextual Application: The difficulty can also depend on the context in which one is practicing. In a fast-paced business environment, managerial accounting can be more challenging due to the need for rapid decision-making. In contrast, in a highly regulated industry, the complexities of financial accounting can be more daunting.

Ultimately, whether financial or managerial accounting is more difficult depends on individual aptitudes, professional backgrounds, and the specific demands of their roles within an organization. Both fields are complex in their own ways and require a dedicated approach to mastering key concepts and skills.