What is the Basic Accounting Equation?

The basic accounting equation is a cornerstone of financial accounting, encapsulating the fundamental relationship between a company's assets, liabilities, and owner's equity.

What is the Accounting Equation?

At its core, the accounting equation is a simple yet powerful tool that defines the basic principle of double entry accounting. It states that a company's total assets are equal to the sum of its liabilities and owner's equity.

This equation is the backbone of a company's balance sheet and is fundamental in understanding financial accounting. It ensures that for every financial transaction, the company's financial position remains balanced. The basic accounting equation formula, Assets = Liabilities + Owner's Equity, is not just a mathematical expression; it's a reflection of a business's financial health and a guiding principle for preparing financial statements.

By maintaining this balance, the accounting equation helps ensure that a company's financial reports are accurate and reliable, providing critical insights into its financial stability and performance.

What are the Elements of the Accounting Equation?

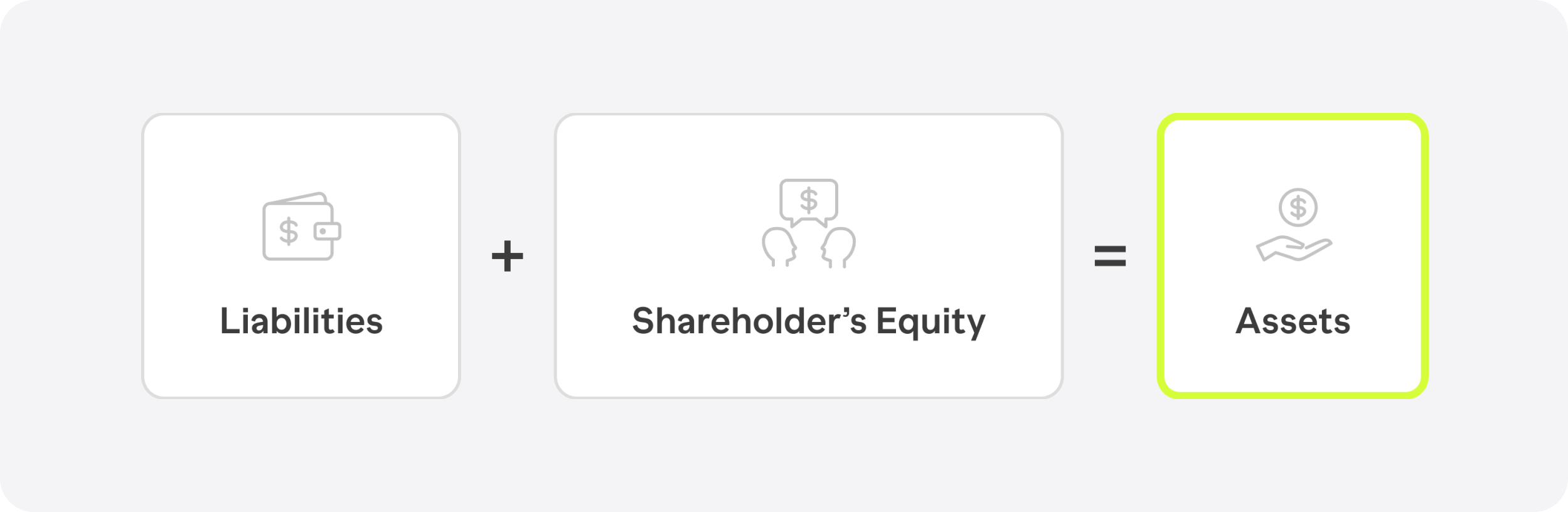

The accounting equation, central to financial accounting, consists of three key elements: assets, liabilities, and owner’s equity. Each component plays a crucial role in reflecting a company's financial position on its balance sheet.

- Assets: These are resources owned by a company, including both tangible items like machinery and intangible ones like patents or trademarks. Assets are what a company uses to operate and generate revenue. Examples include current assets like cash and accounts receivable, as well as long-term assets like buildings and equipment.

- Liabilities: Liabilities are obligations a company owes to others. They are the debts incurred during business operations. This could be short-term financial obligations like accounts payable or long-term debts such as mortgages or bonds payable.

- Owner’s Equity: Also known as shareholder equity or stockholders equity, this represents the residual interest in the assets of a company after deducting liabilities. It includes items like contributed capital, retained earnings, and paid-in capital. Owner’s equity changes with business transactions, reflecting profits earned or losses incurred, as well as dividends paid to shareholders.

Accounting Equation Formula

Central to understanding basic accounting and financial reporting, the formula of the accounting equation is straightforward yet fundamental. It is expressed as:

This formula is the backbone of the double entry bookkeeping system, ensuring that every financial transaction affects two accounts in a way that maintains this equation's balance.

Example of the Accounting Equation

To better understand the basic accounting equation, let’s consider a practical example. Imagine a company, XYZ Inc., which is just starting out. Here's how the accounting equation would apply to its initial financial situation:

- XYZ Inc. begins with $100,000 in cash as its assets. This money was invested by the owners, so it also represents the owner's equity.

- The company decides to purchase office equipment worth $20,000, paying in cash. Now, XYZ Inc.'s total assets include $80,000 in cash and $20,000 in equipment.

- To expand its operations, the company takes a loan of $50,000. This adds to its liabilities.

- After these transactions, the company's balance sheet would reflect the following:

- Total Assets: $100,000 (cash + equipment)

- Liabilities: $50,000 (loan)

- Owner's Equity: $50,000 (initial investment minus equipment purchase)

According to the accounting equation (Assets = Liabilities + Owner’s Equity), XYZ Inc.'s financial position is balanced: $100,000 = $50,000 + $50,000.

This example demonstrates how every business transaction impacts the company's financial statements, ensuring that the accounting equation always stays in balance. It's a clear illustration of the fundamental principle in double entry bookkeeping, where every financial transaction affects at least two accounts

What is the Expanded Accounting Equation?

While the basic accounting equation provides a solid foundation, the expanded accounting equation offers a more detailed view. It breaks down Owner's Equity into specific components, giving a clearer picture of a company's financial position. The expanded equation is formulated as: Assets = Liabilities + Owner's Capital + Revenues - Expenses - Dividends.

- Owner's Capital: This is the amount invested by the owners in the company. It could include both the initial capital and any additional investments made later.

- Revenues: These are the earnings from business operations, like sales or service fees. It's the income generated in the normal course of business.

- Expenses: These are the costs incurred to earn revenues, such as rent, utilities, and salaries. Expenses reduce the overall profitability of the company.

- Dividends: This refers to the earnings distributed to shareholders. Dividends are part of shareholder equity but are subtracted in this equation as they reduce the retained earnings.

This expanded view is crucial for financial reporting and analysis. It not only helps in preparing financial statements but also provides insights into how business transactions affect the company's net income, retained earnings, and overall financial health. It’s a fundamental concept in financial accounting, aiding accountants and financial analysts in understanding the complexities of a company's financial activities.

Expanded Accounting Equation Example

Let's put the expanded accounting equation into practice with a real-world example. Consider a hypothetical company, ABC Tech, during its first year of operation:

- Beginning of the Year:

- ABC Tech starts with an initial owner's capital investment of $100,000.

- The company has no revenues, expenses, or dividends at this point.

- The accounting equation reads: Assets = Liabilities + Owner's Equity ($100,000).

- During the Year:

- ABC Tech earns revenues of $200,000 from its tech services.

- It incurs expenses amounting to $120,000 (salaries, rent, etc.).

- The company pays out dividends of $10,000 to its shareholders.

- ABC Tech purchases equipment for $50,000 on credit, increasing both assets (equipment) and liabilities (loan).

- End of the Year Financial Position:

- Assets: Increase by $200,000 (revenues) and $50,000 (equipment), totaling $350,000.

- Liabilities: Increase by $50,000 (equipment loan).

- Owner's Equity: $100,000 (initial) + $200,000 (revenues) - $120,000 (expenses) - $10,000 (dividends), equaling $170,000.

The expanded accounting equation for ABC Tech at year-end would be:

- Assets ($350,000) = Liabilities ($50,000) + Owner's Capital ($100,000) + Revenues ($200,000) - Expenses ($120,000) - Dividends ($10,000).

This example illustrates how the expanded accounting equation accounts for changes in revenues, expenses, and dividends, alongside owner's equity and liabilities, in the company's financial position. It's a fundamental tool for financial analysts and accountants, essential in preparing accurate financial statements and understanding a company's overall financial health.